Introduction

Throughout

this document the theory of cardinal utility will be analyzed. This theory

includes the economics concept of total utility (TU), marginal utility (MU), and

the law of diminishing marginal utility (LDMU). In addition, this paper

describes consumer behavior and the equimarginal principle for a consumer.

Consequently, the Marshalian and Walrasian approach will be used to explain the

derivation of the demand curve from the cardinal utility. Finally, this

document will explain the consumer and producer surplus concepts.

Cardinal Utility

The

theory of cardinal utility allows people to rank and measure each

commodity with a precise evaluation on the alternatives. “Height, length,

volume, weight are examples of what can be measured with cardinals numbers” (Kamerschen

69). Therefore, using this approach people can calculated the exact numerical

ratio of two cardinal quantities. In economics the unit that allows using the

cardinal approach is UTILS.

Total Utility (TU)

Total utility (TU) is the total level of satisfaction that a consumer

expects to receive by consuming various amounts of a specific good or service.

For example, two cups of water are 20 utils for a specific consumer, and three

cups of water are 25 utils for the same consumer.

Marginal Utility (MU)

Marginal utility (MU) is the extra satisfaction a consumer

receives from consuming one more unit of a good or service. Therefore, “MU is

the change in total utility per unit change in the quantity of a given

commodity consumed, when taste and consumption remain unchanged” … “MU refers

to the slope or the rate of change of the TU function. MU curve or function is

negatively sloped” (Kamerschen 70).

(1.1)

MUx = ΔTUx/ΔQx

Law of Diminishing

Marginal Utility (LDMU)

The law of diminishing marginal utility (LDMU) is a law of economics

stating that as people increase consumption of a good or services, ceteris

paribus (other things equal), marginal utility declines from consuming each

additional unit of that product. Consequently, “the greater the rate of

consumption per unit of time of any particular good, the less it is MU” (Kamerschen

70).

People spend their money in a diverse set of goods and

services. Why do not people spend all their money in only one good or service,

which gives them the most utility? “If (MUx) depends only on the

quantity consume of that good (Qx) and not on the quantity consumed

of other goods (Qy), the argument would be valid. However, if the (MUx)

is not independent of (Qy,), (MUX) could be

increasing and a switch to y could still occur. If the increase consumption of

x raises the (MUy) more than it raises the (MUx),

the (MUx) has fallen relative to (MUy) and the switch

form x to y will occur” (Kamerschen 70-80).

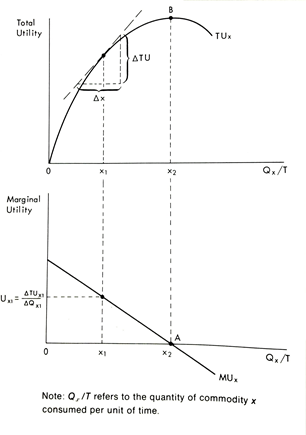

GRAPH 1.1 Total and Marginal

Utility

|

(Kamerschen 72)

|

Graph 1.1 gives a visual explanation of the concepts that

have been discussed, total utility, marginal utility, and the law of

diminishing marginal utility. The TU function starts at 0 and it has a positive

slope until it gets to the maximum, which is labeled B. At B this person does

not get more utility from consuming this product, then the first point in the

MU function has been found. This point is where the MU function is at 0, which

is labeled A. The MU function has a negative slope due to the LDMU. Therefore, it

can be assumed that all the units consumed to the left of point A on the MU

function add value to the TU. (Kamerschen 71)

Consumer

Behavior

Graph 1.2 Equimarginal

principle for a consumer

In order to understand the consumer behavior, first the

equimarginal principle for a consumer must be understood. The goal of the

equimarginal principle is to balance gains and losses. Marginal benefit (MB) or

marginal utility (MU) equals marginal cost (MC); in the contest of consumers MC

equals price (P). Now let’s look at graph 1.2. The price of a pen equals $1.

This person is willing to pay up to $5 for that first pen, therefore, this

person should continue buying pens until the MC equals the MB which in this

case happens when the fifth pen is bought. (Kamerschen 73)

“The Equimarginal principle says this rule should be applied

to every commodity consumed in order to get optimum division of expenditures”( Kamerschen

74).

(1.2)

Mux/Px=MUy/Py or Mux/MUy= PX/PY

The equation shown on (1.2) says that consumers maximizes

total utility when they are buying the quantities of x and y that allow the MU

per $ spent on x be equal to the MU per dollar spent on y. “Mux/MUy represents

the rate at which the consumer is willing to substitute y for x, and PX/PY represents the rate at which the consumer is

able to substitute y for x. When Mux/Px=MUy/Py is met, the last dollar spent on x

yields the same MU as the last dollar spent on y” (Kamerschen 74).

Table 1.1 Two-good Consumer Optimum,

Marginal Utility Approach

|

(Kamerschen 75)

|

The table 1.1 allows us to visualize the concepts of the equimarginal

principle with a two good situation. The

price of x (Px) equals to $1 and the price of y (Py)

equals to $1, also this consumer has a limited income of $13. To allocate the

money in the best possible way the MUx and MUy for

different quantities of x and y (Qx, Qy) are shown in the

table. Therefore, the buyer will buy the good with the higher MU until he or

she has spent all the income. In this example the consumer will buy 5 units of

x and 8 units of y which both have an equal MU shown at 16 utils (Kamerschen 75).

(1.3) ΔMUy/ΔQx=ΔMUx/ΔQy=

0

(1.4) Mux/Px=MUy/Py=MUz/Pz=…=

λ(common MU per income

dollar)

This “states that the optimum point, marginal utilities must

be in proportion to their prices for all the commodities purchased” (Kamerschen

76).

(1.5) I=Qx

* Px +Qy * Py +Qz *Pz

This “means that the consumer has a budget constraint, so

that total expenditures can not exceed income” (Kamerschen 76)

(1.6) LDMU holds in the case of independent commodities.

This “states that if the commodities are unrelated, the LDMU

must hold” (Kamerschen 77).

Table 1.2 Three-good Consumer

Optimum, Marginal Utility Approach

|

(Kamerschen 78)

|

Table 1.2 allows us to visualize the concepts of the equimarginal

principle with a three good situation. The price of x (Px) equals to

$2, the price of y (Py) equals to $3, and the price of z (Pz)

equals to $1, also this consumer has a limited income of $26. To allocate the

money in the best possible way the MUx, MUy and MUz

(shown on columns 2, 5, and 8) for different quantities of x, y and z (Qx,

Qy, Qz) are shown in the columns (1, 4, and 7). Also the

MU per dollar of each commodity is shown in columns (3, 6, and 9). In order to

find the optimum output, (1.4) and (1.5) must be met. This means that only one

convention of goods (x=2, y=6 and z= 4) will satisfy both (1.4) and (1.5) where

the MU per dollar is equal at 8. There are other conventions that will meet

(1.4) however, not all the income will be spent, which does not meet (1.5) (Kamerschen

76-78).

Derivation of

the Demand

Marshallian Approach

Graph 1.3 Derivation of the

Demand curve (Marshallian)

Market price of P=$2.00 a unit, Pl=$1.50

a unit, Pll=$1.00 a unit

|

(Kamerschen 81)

|

In order to derivate an individual demand curve Dx under

the Marshallian approach the assumption that the MU of money is invariant

(which means that he ignored the income effect) must be done. “Both MUx

and Dx curves measure the Qx on the horizontal axis,

whereas the MU curve measures the MUx on the vertical axis and the

demand curve measures the Px on the vertical axis” (Kamerschen 81). The quantities that the individual buy at

different prices $2.00 a unit, $1.50 a Unit, and $1.00 a unit must be known. The

equation shown in (1.7) shows how to solve for each point in the graph. Since

it is an algebraic equation it can be rewritten as in (1.8). Assuming that the

MU of money

is constant and equal to four utils, and

the Px equal to $2, this consumer will buy 3 units of x because

. This shows that the

consumer will buy 3 units at this price. Therefore, we found our first point in

the demand curve. Then we repeat the process for $1.50 and $1.00 and we find

that at $1.50 the consumer will buy 5 units and at $1.00 will buy 8 units.

(1.7)

Mux/Px

= λ = common MU of money

expenditures

(1.8) Mux=Px

* λ

Walrasian Approach

Graph

1.4 Derivation if the Demand Curve (Walrasian)

“Assuming that price of x is Px1, the price of Y

is Py1 and the respective quantities X1 and Y1.

Also assuming that Px1 is twice Py1, MUx1 must

be twice MUy1. This gives us the first point on the demand curve as

shown on graph 1.4. To find the second point on the demand curve let’s raise

the price of x to Px2, as shown on equation (1.9). We find this is

not at equilibrium any more. Since the price increased the consumer spent more

money on x than y, therefore, the MUy1 increased to MUy2 as

shown in equation (1,10), which tell us that this consumer shifted the money

from x to y. However, this still is not at equilibrium. Since this consumer is

spending more on y the new MUy3 is lower and we find a second point

on the equation as shown in the equation (1.11). A second point on the demand

curve has been established: Px2, X2 (Kamerschen 83-84).

(1.9) Mux1/↑PX2

< MUy1/Py1 so (1.10) Mux1/Px2

< ↑MUy2/Py1 so (1.11) Mux2/Py1=

MUy3/ py1

Consumer and

Producer Surplus

Surplus represents

the fact that consumer and producer’s total economic welfare from the

transaction of a good or service is greater than the utility of its monetary

value (Kamerschen 85).

Marshall Approach of consumer surplus

Assumptions:

is constant there is no income effect

Table 1.3 Calculation of

Consumer Surplus

|

(Kamerschen 86)

|

Graph 1.5 Consumer and

Producer Surplus

|

(Kamerschen 87)

|

Graph 1.5 and

table 1.3 explain the consumer surplus. We can see that for the first unit the

consumer is willing to pay up to $10. At the first unit he has no surplus. For

the second unit he is willing to pay $9. This gives him a $1 surplus. Since the

market price is set at $5 he is willing to buy up to 6 units, which generates a

surplus of $4+ $3 + $2 + $1 or $10. This example deals with discrete

units. If fractional units were not available, the demand curve would be the

step function under Dx

Producer Surplus is analogous to the consumer surplus, which means that

the producer was willing to sell that first unit at a lower price. At the

market price the producer surplus is equal to $9 (Kamerschen 85-87)

Conclusion

Throughout

this document the theory of cardinal utility has been analyzed. This theory

includes the economics concept of total utility (TU), marginal utility (MU),

the law of diminishing marginal utility (LDMU). In addition, this paper

described consumer behavior and the equimarginal principle for a consumer.

Consequently, the Marshalian and Walrasian approach were used to explain the

derivation of the demand curve from the cardinal utility. Finally, this

document explained the consumer and producer surplus concepts.

Work Cited

Kamerschen,

David R, and Lloyd M. Valemtine. Intermediate

Microeconomics Theory. Cincinnati: South-Western Publishing Co, 1977.

Print.

No comments:

Post a Comment